7 eleven financing decision debt and euity

From the table we can see 7-Eleven Debt ratio in 2015 had increase 43 from 2014. 26 Feb 2018.

Cld Assignment Vbe1007 Credit And Lending Decisions Vu Studocu

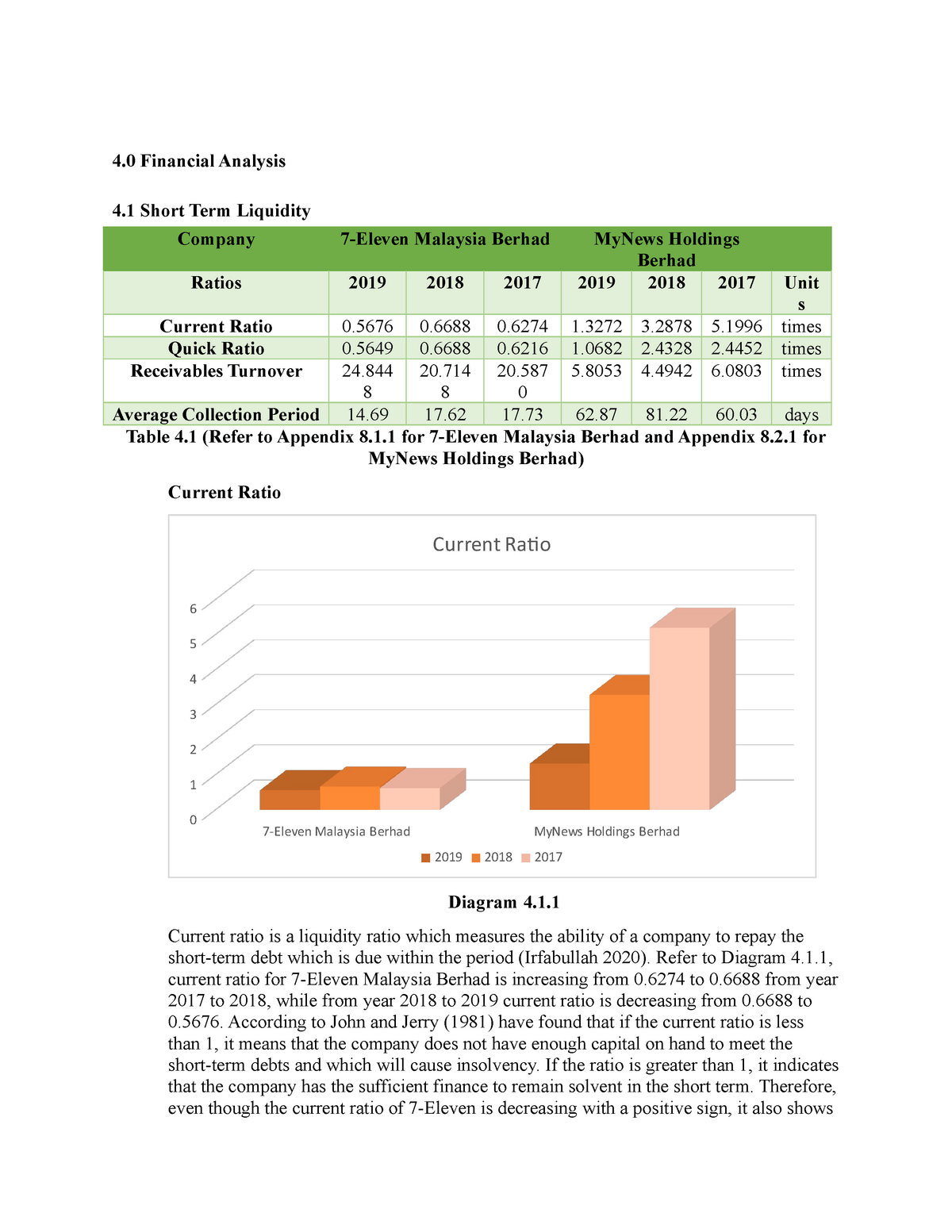

The purpose of the study is to analyse the financial ratios of the 7-Eleven Malaysia Sdn Bhd.

. Call protection generally prohibits a debt issuer from prepaying the debt early on in the life of the issue. Disclosure of Capital Structure Telekom Malaysia Holdings TM 7-Eleven Malaysia Holdings Berhad The pattern of Capital Structure Capital Structure with equity shares and debentures The primary source of financing Debt Debt The secondary source of financing Equity Equity Amount of Debt RM000 1904660 1319908 Amount of Equity RM000 655310 102111 Current. Moodys announces completion of a periodic review of ratings of 7-Eleven IncGlobal Credit Research - 10 Feb 2022New York February 10 2022 -- Moodys Investors.

This would not be the first time that Reliance Global Groups stock has been squeezed. Is the absolute best management having huge salary and cashing out. 7-Eleven Malaysia Holdings Bhds preferred stock for the quarter that ended in Sep.

Start your Free Trial. Click the image for more detail. Forcasts revenue earnings analysts expectations ratios for 7-ELEVEN MALAYSIA HOLDINGS BERHAD Stock SEM MYL5250OO005.

Of this study is to analyse the financial performance of 7 eleven for two consecutive y ears 2019 and 2020. This site is not intended for media current or prospective equity investors. For lenders the financing has call protection to protect the upside of the investment and can have a first or second priority lien to protect the downside.

As you can see below at the end of December 2020 7-Eleven Malaysia Holdings Berhad had RM5355m of debt up from RM1494m a year ago. As a private company we make financial information available only to authorized institutions. The EVEBITDA NTM ratio of 7-Eleven Malaysia Holdings Bhd.

7-ELEVEN MALAYSIA HOLDINGS BERHAD. Is significantly lower than the average of its sector Food Retailers Wholesalers. Every 100 RM of its total equity.

Debt InvestorsAccess to Secure Financial Information. Although 7-Eleven had reduced their borrowing from 7k to 2k but increased their trade and others payable and less bank balance these few sectors will affect the ratio. The highest number of days for which 7e was able to hold off its debt payment was 116 days.

Founded in 2015 Eleven is an Independent Research Provider IRP with a mission to assist investors around the world to make the best investment decisions. OCS is a structure that can be classified as a liabilities to company. 2021 View and export this data going back to 2014.

Optimum capital structure OCS is best known as an avenue where company finances its assets by chosen the right combination of debt equity or hybrid securities. 7-Eleven Malaysia Holdings Bhd Preferred Stock. By means of proprietary analysis we cover the all Brazilian investment assets classes.

For questions regarding access to 7Eleven Incs financial information please email. Our team is guided by technical precision discipline and responsibility with independent analysis. New York February 26 2018 -- Moodys Investors Service Moodys today confirmed the Baa1 long-term rating of 7-Eleven Inc.

The Prime-1 commercial paper rating was affirmed. For better still it can be known as the ratio of various type securities of the company for long term financing. The financing decision of the firm.

Its ROE is pretty good but given the impact of the debt were less than enthused overall. If you qualify 7Eleven has an internal program that provides up to 65 financing on your initial franchise fee. 7-Eleven Malaysia Holdings Berhads Debt And Its 22 ROE.

However it does have RM2063m in cash offsetting this leading to net debt of about RM3292m. 2021 was RM0 Mil. The rating outlook is stable.

7-Eleven Malaysia Holdings Bhd balance sheet income statement cash flow earnings estimates ratio and margins. This program which is uncommon to most franchisors also provides an open account or financing for the inventory purchases and operating expenses of. Earlier this year RELI stock leapt 664 vaulting from 561 per share up to 4286 between Feb.

Having financial and accounting understanding can create a difference in the achievement of your little business. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on 7 Eleven Malaysia. Ratio less than 1 mean that a company has more assets than debt.

The overall trend shows that 7 eleven improved its performance. Financial statements provide crucial details about a companys performance but they can. According to these financial ratios 7-Eleven Malaysia Holdings Bhds valuation is way below the market valuation of its peer group.

Preferred stock is a special equity security that has properties of both equity and debt. It seems that 7-Eleven Malaysia Holdings Berhad uses a huge volume of debt to fund the business since it has an extremely high debt to equity ratio of 331. A number of financial ratios are estimate and analyse.

This action concludes the review for downgrade that was initiated on January 31 2018. Announcement of Periodic Review. The level of parental support from its Japanese parent Seven-Eleven Japan Co LTD SEJ and its ultimate parent Seven i is significant led by the planned 8 billion equity infusion to effectuate the Speedway acquisition the guarantee of its commercial paper program the 970 million loan to finance the Sunoco purchase as well as the conversion of 300 million.

Financial statements After the collapses of companies like Enron it is not surprising that financial statements have received renewed attention. RM0 Mil As of Sep. 7ELEVEN 7 eleven is well-known franchise in the world a s in Malaysia.

7 Eleven Financial preparation and management companies reveal an instructions to the business to manage your finance related troubles. Analysis Results Comparison of 7 Eleven Sdn Bhd Financial Ratios Based On Year 2019 And 2020 Profitability Ratios 2019 2020 Return On Equity 3355 5297 Gross Profit Margin 3163 2843 Liquidity Ratios 2019 2020 Current Ratio 055 063 Quick Ratio 023 031 Cash Ratio 013 015 Market Value Ratios 2019 2020. The financing can either be fully committed or subject to best efforts.

Corporate Finance Valuation Modeling Expert Leveraging Data to Drive Decision-Making Senior Manager FPA - Digital Finance at 7-Eleven CFA Institute. KLSESEM Debt to Equity History May 12th 2021. View 5250MY financial statements in full.

Return on equity is useful for comparing the.

Seven I Seeks To Expand Us Convenience Store Lead With 21b Speedway Deal S P Global Market Intelligence

Pdf Choice Between Debt And Equity And Its Impact On Business Performance

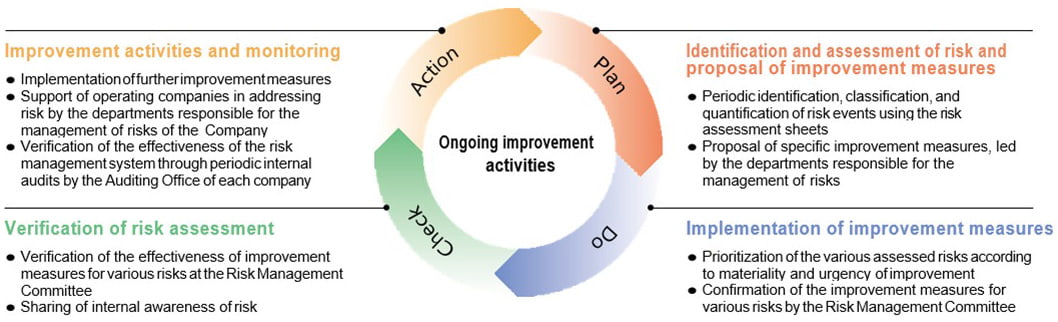

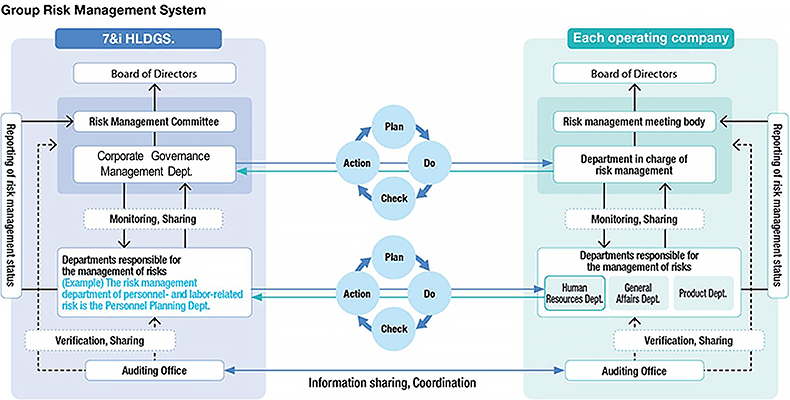

Risk Factors Investor Relations Seven I Holdings Co

Seven I Seeks To Expand Us Convenience Store Lead With 21b Speedway Deal S P Global Market Intelligence

Risk Factors Investor Relations Seven I Holdings Co

0 Response to "7 eleven financing decision debt and euity"

Post a Comment